Capital growth with less of the volatility of equities

Investment Objective: To target capital growth with less of the volatility of global equities at a rate of 3-4% in excess of a composite target benchmark over a five year period; net of fees.

Target Benchmark: This is a benchmark unique to Tellsons and FTSE Russell to incorporate the ‘risklessness’ of UK government bonds as well as the ever-present risks of inflation. It comprises 50% UK CPI five-year average and 50% UK Conventional Gilts up to five years index; and volatility vs MSCI World GBP Hedged.

Investment Philosophy: We believe growth equity investments can often come with too much volatility on their own, making it an uncomfortable ride for many investors forcing them to give up on their long-term investment plans. We seek to reduce much of that volatility by combining growth with income yielding investments and downside protective strategies to reduce volatility in times of market stress.

Investment Process: Minimum 80% invested in global equities and corporate bonds whilst seeking to reduce volatility by investing in government bonds, instruments with exposure to precious metals, unhedged foreign currency and the use of derivatives for efficient portfolio managements purposes, including hedging to reduce risk.

Four concentrated investment themes

The Fund Managers select investments for four highly concentrated sub-portfolios to deliver the overall fund objective.

These comprise 10 best ideas for Secular Thematic Growth, Defensive Strength, Cyclical Leadership and less correlated, sometimes even negatively correlated Protective strategies.

Different risk and return profiles within global equity investments are combined with ‘safe haven’ bond investments, precious metals exposures and unhedged foreign currency as they can move in opposite directions during times of market stress, potentially offsetting losses from the equity investments and reducing the volatility of the Fund overall.

Building the portfolio

The Fund Managers bring decades of experience from different corners of the investment markets.

They combine their different skills and analytical approaches into one integrated Endeavour process: to combine higher risk equity investments for growth upside with lower risk bond and other diversifying investments to protect from the worst market downside.

Tellsons’ own in-house process, PETRA, is used as a fundamental bottom-up framework for assessing risk-adjusted returns between investments at different stages of the business cycle.

Confidence with Caution – Protecting the downside

Confidence with caution is the guiding principle for the EF Tellsons Endeavour Fund managers as they seek to achieve a steadier risk and return performance profile.

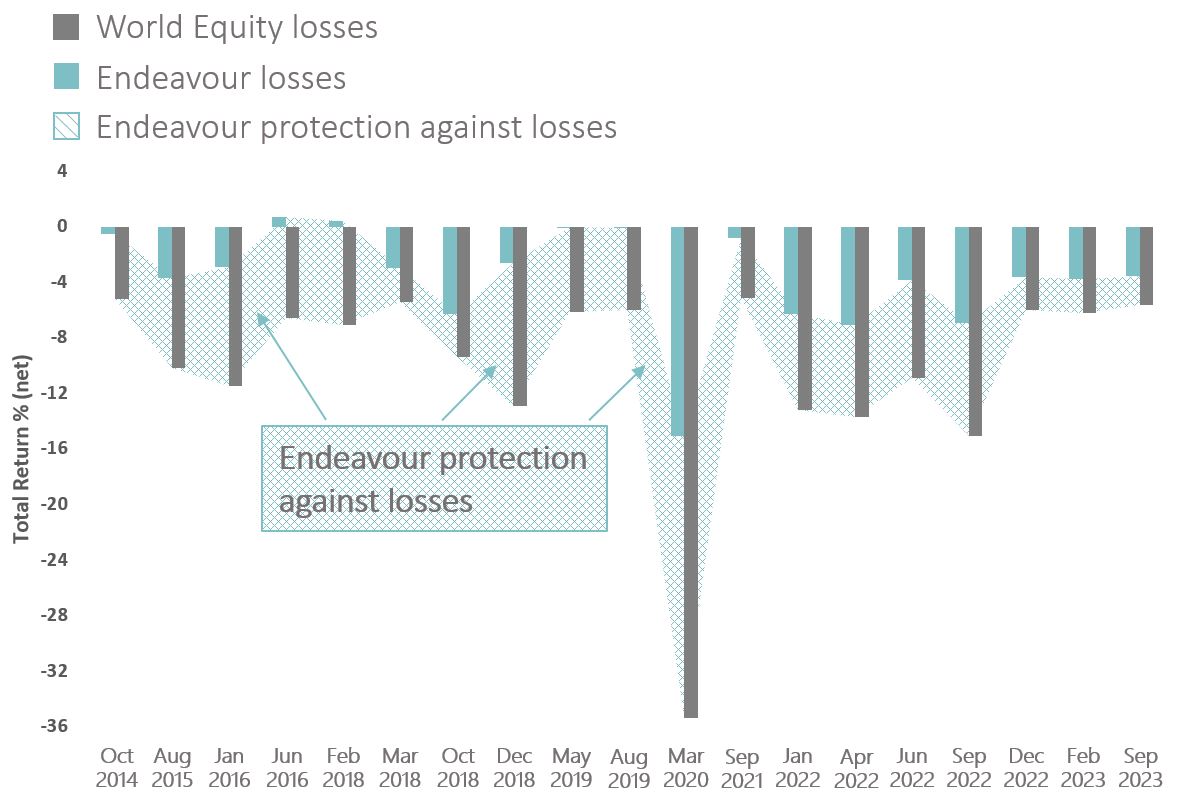

Chart 3. The chart illustrated highlights the 67% downside protection on average that the Endeavour Fund has offered investors in the worst equity market falls since inception.

Source: Bloomberg, from 03.02.14 to 29.12.23, Total Return net of fees/costs.

Periodic market declines may extend beyond the calendar month and defined as periods where the World Equity (MSCI World £ hedged index) dropped more than -5%. The periods start from the beginning of the fall in price and terminate at the lowest point (trough) before subsequent recovery.

Endeavour

Sustainability

Factsheets

Reports

Ratings

Platforms

People

Contact

Our registered address is: Tellsons Investors LLP, 4 Woodfall Street, London, SW3 4DJ

Please feel free to contact us directly if you have any questions about the Fund or require further information about the strategy or the fund holdings.

We do not offer investment advice tailored to your individual circumstances. Please speak with your Financial Adviser if in doubt.

Please email: enquiries@tellsons.co.uk with any questions that you have. We will endeavour to respond to questions within 24 hours, if not sooner.

We are active on the LinkedIn platform with news, views and commentary – please do follow us here

Investing made as simple as possible

You may invest direct via the Authorised Corporate Director - further contact details available below.

This will take you direct to the Way Fund Managers’ website where you will be able to access fund information such as Key Investor Information Document, Annual Reports and investment subscription forms:

or

Call: 01202 855 856

(09:00 – 17:00 Monday to Friday )