In this edition of our ‘In Brief’ series we explore the theme of ‘Sustainability’. Sustainability has become an integral part of the investment landscape in recent years, and with it a variety of different approaches and subjective standards. We have always sought out the qualities of ‘sustainability’ in the investments we make and here we set out our approach in the context of the environmental, social and governance standards that have become prevalent in recent years.We examine some of the more controversial ESG challenges through the lens of our sustainability investment policy, with examples of the companies we invest in and how we think pragmatically about their business models, the sustainability of their investment returns and the industries they operate in.

How we think about ‘sustainability’

The word ‘sustainability’ is defined by the Oxford Dictionary as “the ability to be maintained at a certain rate or level”. This can be applied to all manner of activities, from the output of a factory to the pace of an athlete. In recent years a secondary definition in relation to the environment has taken prominence: “the avoidance of the depletion of natural resources in order to maintain an ecological balance”.

From an investment perspective, the impact that business has on the environment, and on society more broadly, has increased greatly in significance since the Paris Climate Agreement in 2015. With last month’s COP26, the UN Climate Change Conference, there is renewed interest in the role that companies and their investors should play in combatting climate change, as well as ongoing social and governance issues.

As the importance of environmental, social and governance (‘ESG’) issues among investors has grown, there has been a corresponding increase in the number of funds focusing on ESG outcomes. This has caused regulators on both sides of the Atlantic to highlight the risk of ‘greenwashing’. Gary Gensler, Chair of the Securities Exchange Commission, said: “Many funds use terms like ‘green’ or ‘sustainable.’ Even though those terms are a little less objective than ‘fat-free’ milk, still, those labels say a lot to investors. … I think investors should be able to drill down and see what’s under the hood of these funds”.[i]

The fact is that ‘ESG’ or ‘sustainable’ can, without any nefarious attempts on behalf of the fund manager, cover many different perspectives. They simply mirror the wide spectrum of opinion that exists on how we, as a society, should manage the impact we have on the environment.

For example, palm oil is a product that has a myriad of uses and is found in 50% of packaged products in supermarkets – from pizza to shampoo. The demand for palm oil, however, has driven vast deforestation, primarily in Indonesia and Malaysia. One option for investors is to invest in companies that produce palm oil in a sustainable way, as recommended by the World Wildlife Fund.[ii] The other is to shun producers of palm oil entirely, whether sustainable or not, and push companies to find alternatives, as proposed by Greenpeace.[iii] Both behaviours are supportive of change, but which should be considered the standard for sustainability?

The boundary between land cleared for palm oil and intact forest in Malaysia

At Tellsons we have always tried to factor sustainability, and particularly ESG, into our investment decisions. Our PETRA investment methodology allows us to compare the valuations and returns from companies across sectors and asset classes. Within that, a company’s ESG score is one of the adjustment factors that we use pragmatically, alongside other factors such as diversification benefit and sector outlook, to measure an investment’s valuation. This is because we believe companies that rank highly for ESG not only are trying to make a positive contribution to the world they operate in, but also have a management strategy and governance culture that reflects the highest operational standards, and so will more likely drive a business model that is sustainable over the long-term, and produce high quality investment returns too.

While ESG considerations are an important factor in our investment process, sustainability is our primary focus. By that, we mean sustainability’s primary definition as it applies to investment returns: ‘the ability to be maintained at a certain rate or level.’ The Endeavour Fund aims to weather the volatility of the business cycle, to protect against downside risks while participating in the growth of the economy. To deliver this for our investors we seek sources of return that we feel can be sustained over the long-term, from businesses that can be relied on to consistently deliver on expectations. Steady growth in earnings, consistency of dividends and the security of bond coupons, are the starting points of our process.

How we implement our view on ‘sustainability’

The energy sector is at the forefront of the debate over how to address humanity’s impact on the climate. Our reliance on fossil fuels for energy make up over two-thirds of global greenhouse gas emissions.[iv] Clearly that figure needs to be reduced considerably if the targets set by the Paris Climate Agreement are to be met. It may not be the view of some, but we feel that oil companies can be part of the solution, and not just the problem.

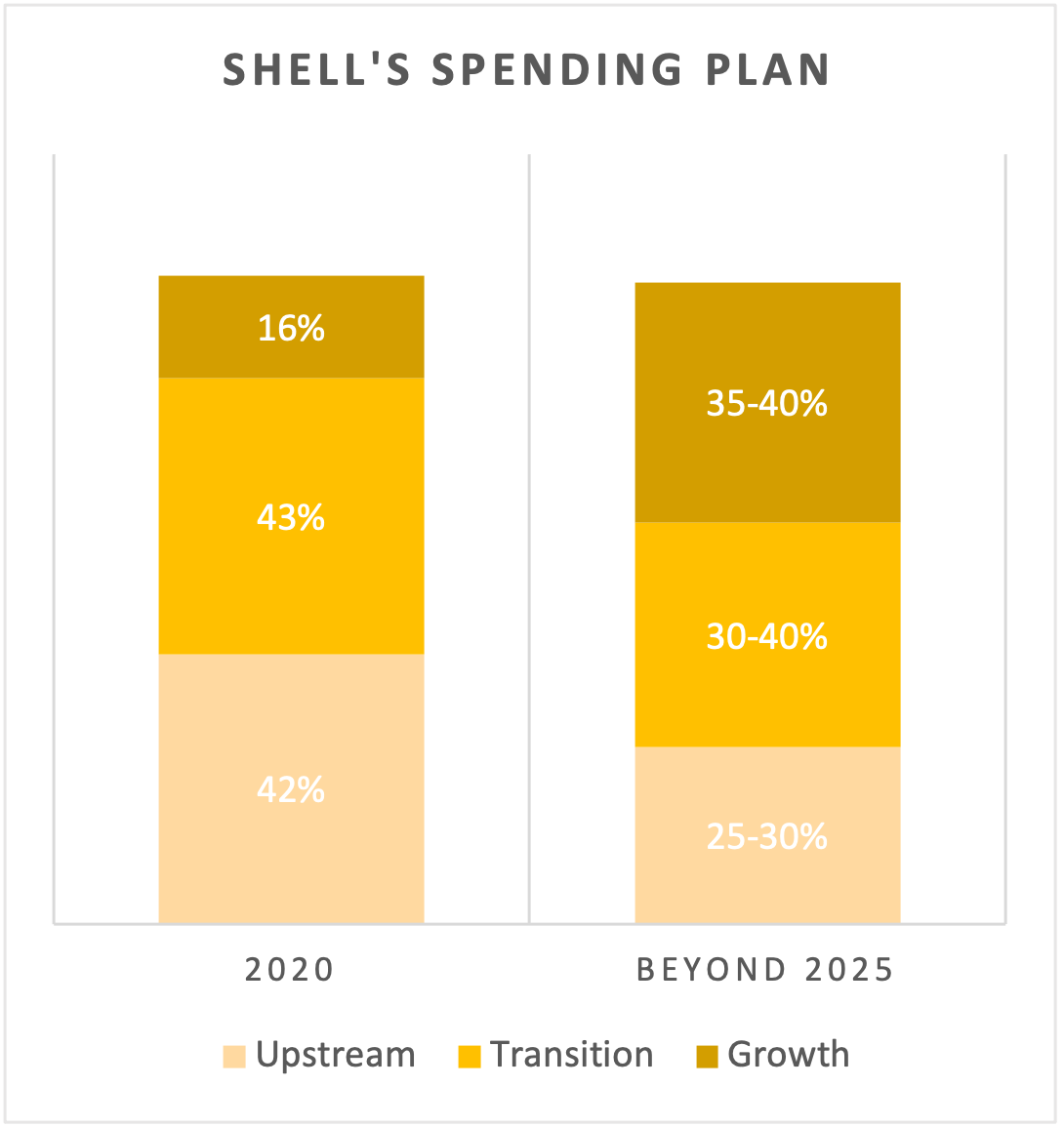

According to the International Energy Agency, natural gas has a significant role to play in providing reliable and affordable electricity during the transition to net-zero carbon energy production, likely for much of the next generation.[v] Royal Dutch Shell had already signalled a shift in focus towards natural gas through its acquisition of BG Group in 2016. The company recently updated its strategy to navigate the ‘carbon transition’. It plans to reduce capital expenditure on upstream oil and gas by 30-40% in the next four years, while increasing cash spent on its ‘growth’ pillar, which includes renewable energy and vehicle charging stations, by at least 120% in the same timeframe.

Shell’s capital expenditure evolution towards the growth pillar of renewable energy (Source: Shell ‘Energy Transition Strategy 2021’)

We have supported the company’s commitment to transition towards natural gas right from the start, whilst also prizing their integrated business model and impressive technical capabilities in the search for and investment in longer-term alternatives. These should enable the company to continue to deliver consistent returns, especially from dividends, which are more sustainable now following the re-basement in 2020.

As in the example of palm oil, there are some who will argue that investment support for any oil company is incompatible with achieving the UN’s climate goals. Others, like us, would argue that those companies that are balancing their responsibilities between serving their social purpose and leading the innovation required to change our energy consumption are deserving of our support and engagement.

The mining sector, however, produces the most carbon intensive energy source of all in coal. Thermal coal is inefficient and power stations powered by it produce twice as much carbon dioxide as natural gas.[vi] There are many countries where coal still plays a significant part in their energy production. Even countries such as Germany where nuclear power is to be entirely phased out by 2022 in response to the Fukushima disaster in 2010.

Anglo American intends to increase copper production from its mines in Chile by 50% by 2024

Nevertheless, coal’s viability as an energy source is under increasing pressure from governments. In 2020 coal provided just 2% of the UK’s energy generation, down from 40% in 2012 and 0% is targeted by 2024.[vii] We welcomed, therefore, Anglo American’s decision to spin-off its thermal coal assets, but these were only 4% of the company’s revenues in 2020. Of more interest to us are its copper assets that will grow from 19% to 50% of operating profit by 2024 due to sustained, structural demand from major components of the energy transition, such as electric vehicles and wind turbines.[viii] Our pragmatic approach recognises that some dirty industries will be crucial in enabling the move to a cleaner world.

At the other end of the economy to fossil fuels are consumer brands. Whether producing luxury handbags or disinfectants, these companies are more reliant on consumers’ perceptions of them and their products. The size of large consumer staples businesses, such as Nestle or Procter & Gamble, means they have correspondingly large environmental and social footprints, from the packaging they produce, to the treatment of their suppliers who are often in developing countries.

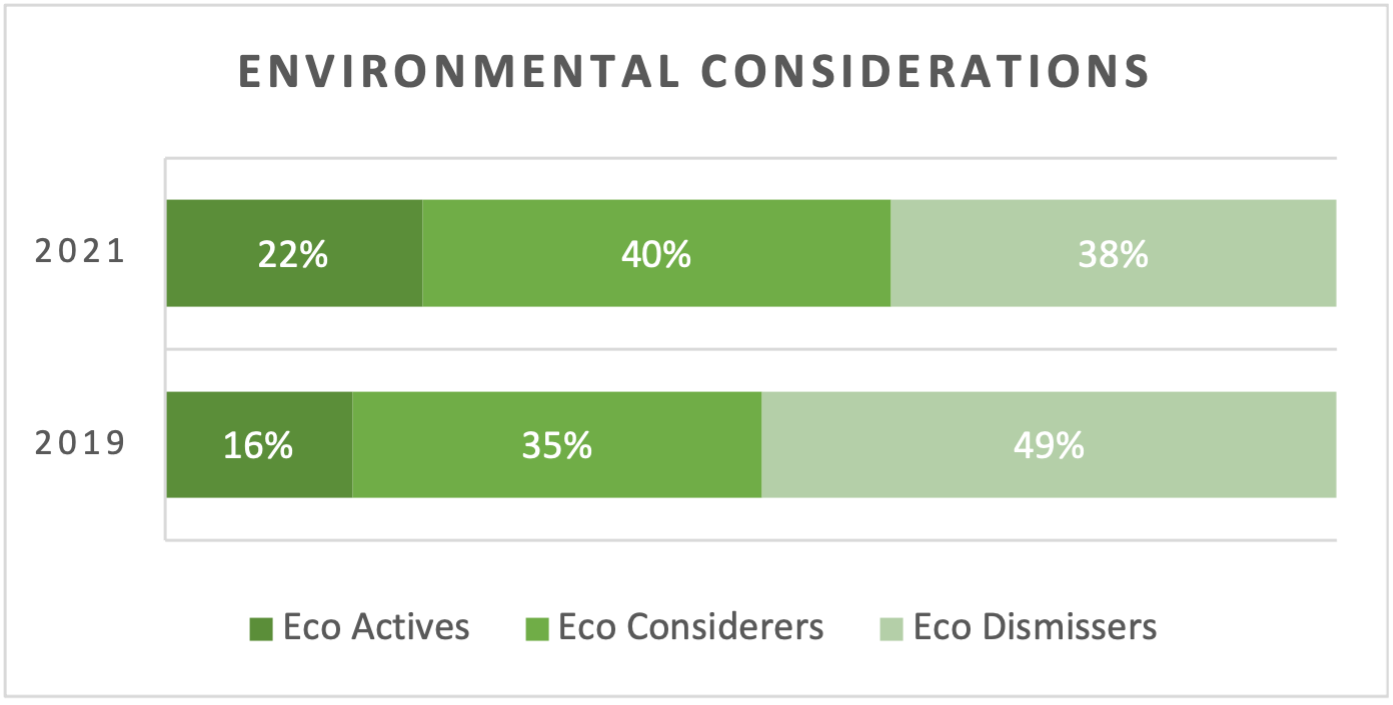

The importance of brand to the success of these companies means that it is no surprise that they have tried to get ahead of sustainability issues and promote themselves to customers as clean and green. The scale of their brands allows them to generate the cashflows and exert the buying power to force significant change, not just environmentally but across all ESG issues. It also means they produce dependable revenues throughout the business cycle, from which they can generate sustainable growth and returns to investors.

The increasing importance of the environment in consumer habits (source: Kantar)

It is not just how consumer products are produced that is under scrutiny from investors, but the very products themselves. The health risks associated with high levels of salt and sugar in food and drinks are such that they have been the target of both government advertising campaigns and legislation. The best food and beverage companies are proactive in managing their portfolios to address this. For example, PepsiCo recently announced the disposal of its fruit juice brands, including Tropicana, to allow it to focus on “healthier snacks and zero-calorie beverages”. It might seem strange but despite being of nutritional value, the high, naturally occurring sugar in fruit juices mean they face many of the same regulatory pressures as carbonated soft drinks. As consumers became more health conscious, sales from its fruit juice portfolio began to decline.

Pepsico sold Tropicana to improve its portfolio from a nutritional and financial perspective

Furthermore, the operating profit margins of around 5% were dilutive to the company’s average of 15%. By selling the juice brands, PepsiCo has not only responded to change in its customers’ appetites, but also improved the financial profile of the company overall. The ability of the leading consumer brand companies to combine the needs of their customers with the interests of shareholders create truly sustainable business models.

There are some consumer products where government efforts to control their consumption go beyond advertising campaigns. Alcohol is both age-restricted and heavily taxed on account of the damage that misuse can have on people’s health. For some ethical investors, the sector may be un-investable. We see things differently.

Diageo is the world’s largest spirits maker and has focused on the premium end of the spirits market as consumers across the globe become more selective in their consumption. It has even moved into non-alcoholic spirits through its acquisition of Seedlip in 2019. As consumers shift to drinking less, Diageo’s revenues have grown over the last 6 years at an annualised rate of 4%, with pre-pandemic margins steadily increasing. We believe Diageo’s premiumisation strategy will sustain returns for investors, even as alcohol consumption falls.

Diageo has promoted responsible drinking by producing an entire Guinness advertising campaign to encourage drinking water

Tobacco shares many of the same characteristics as alcohol. It is age-restricted, heavily taxed, but nonetheless legal. All the tobacco companies are trying to prop up falling revenues from flagging western demand through alternative, smoke-free products. Philip Morris, the manufacturer of Marlboro, says that it could stop selling tobacco cigarettes in ten years, and has recently acquired Vectura, the UK manufacturer of inhalers for asthma, amid a storm of controversy.

Perhaps their transformation will work, however we will not be investing. Tobacco, though legal, is undoubtedly harmful even in moderation. We find neither the product, nor the return profile of these companies attractive. In short, they lack sustainability however defined.

At Tellsons, our pragmatism towards the constantly evolving landscape of ESG issues allows us to support companies like those mentioned here that are trying to improve their environmental and social impact, and attain the highest governance standards, while continuing to deliver attractive returns for their shareholders.

There are many different styles of investing, and many different opinions of what makes a good investment. Our approach begins with needing to have confidence as shareholders in the returns on offer from our investment. An important part of that is our belief in the management’s ability to meet the demands of their customers to grow revenues and ultimately higher profits. As environmental and social issues gain greater precedence in the decision-making of customers across all industries, a virtuous circle is formed, whereby the highest quality companies in each sector can drive improvements in a variety of ESG issues, which in turn strengthen their brands, optimise their portfolio businesses, attract revenues, and produce stronger profit growth.

These companies will truly deliver on sustainability, in every sense of the word.

—————————————————-

References:

[i] SEC Chairman Gary Gensler, Prepared remarks before the Asset Management Advisory Committee, 7th July 2021

[ii] https://greenpalm.org/about-palm-oil/sustainable-palm-oil

[iii] https://www.greenpeace.org.uk/news/5-problems-with-sustainable-palm-oil

[iv] https://www.ipcc.ch/2020/07/31/energy-climatechallenge

[v] https://iea.blob.core.windows.net/assets/cc35f20f-7a94-44dc-a750-41c117517e93/TheRoleofGas.pdf

[vi] http://www.eiris.org/blog/fossil-fuels-logic-divestment/

[vii] https://www.gov.uk/government/news/end-to-coal-power-brought-forward-to-october-2024

[viii] https://energymonitor.ai/tech/renewables/weekly-data-why-keeping-an-eye-on-copper-is-vital-for-the-energy-transiti